The world’s wealthiest business people are richer than they were a year ago and have generally prospered from the pandemic, largely on the back of high-performing technology, industrials and healthcare stocks, and their own business successes. The combined wealth of this cohort increased from $8 trillion last year to a record $10.2 trillion to the end of July 2020, co-authors UBS and PwC revealed in a new report today.

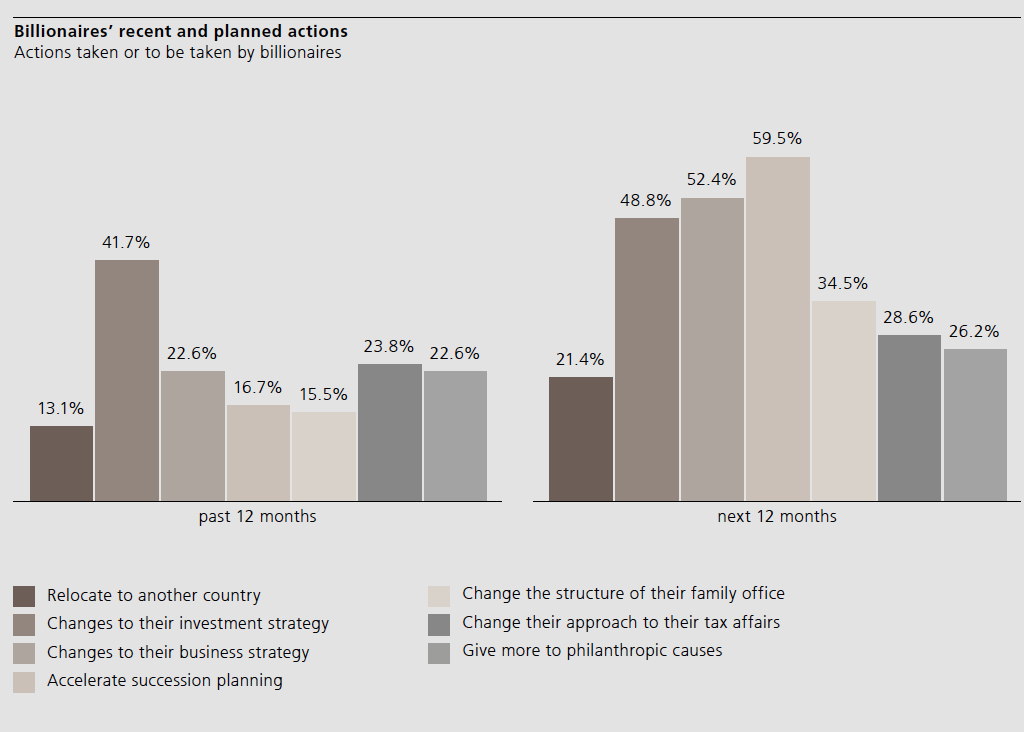

The report this year identifies several trends hastened by the pandemic, most notably a need for advisors to focus on succession planning. PwC’s survey of around 100 top wealth managers revealed that getting the family house in order now ranked as the top priority for UHNW clients in the next 12 months. Second was reviewing their business strategy, including questioning whether they need more capital, more liquidity, or whether they still have the right skill set?

The managers surveyed also expect the ultra-wealthy to review their long-term investment strategy and the structure of their family offices in light of market volatility. The overriding if unsurprising message is that COVID has accelerated the need to speed up wealth planning and wealth transfer.

In a call to discuss the report, UBS said that billionaires are clearly feeling a need for a higher allocation to real assets and in real productive assets such as investing in companies, public and private. The big story is “'Do I have too much wealth in nominal assets,'" said Max Kunkel, CIO for UHNW at UBS.

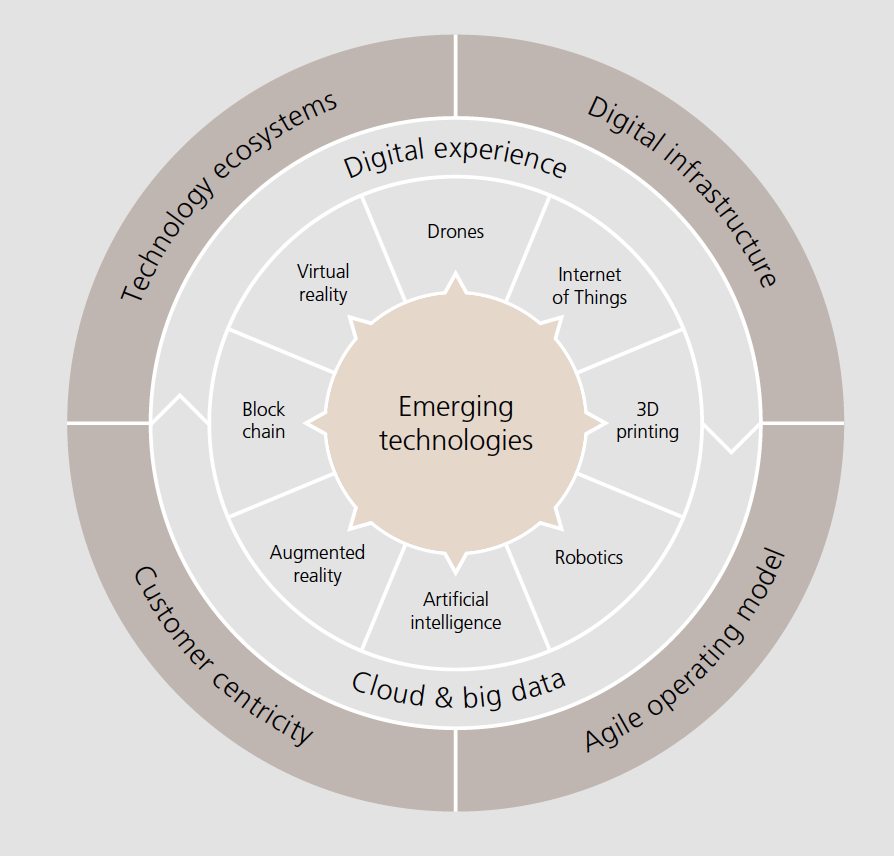

Winners and losers among the current crop of billionaires crudely divide along businesses that are using technology to innovate and disrupt and those trapped in struggling sectors, shown up further by the health crisis. That first group has been dramatically pulling away from the second over the last couple of years. Those identified as innovators and disruptors grew their wealth by 17 per cent to $5.3 trillion over the last two years, while the wealth of traditional billionaires grew by just 6 per cent to $3.7 trillion.

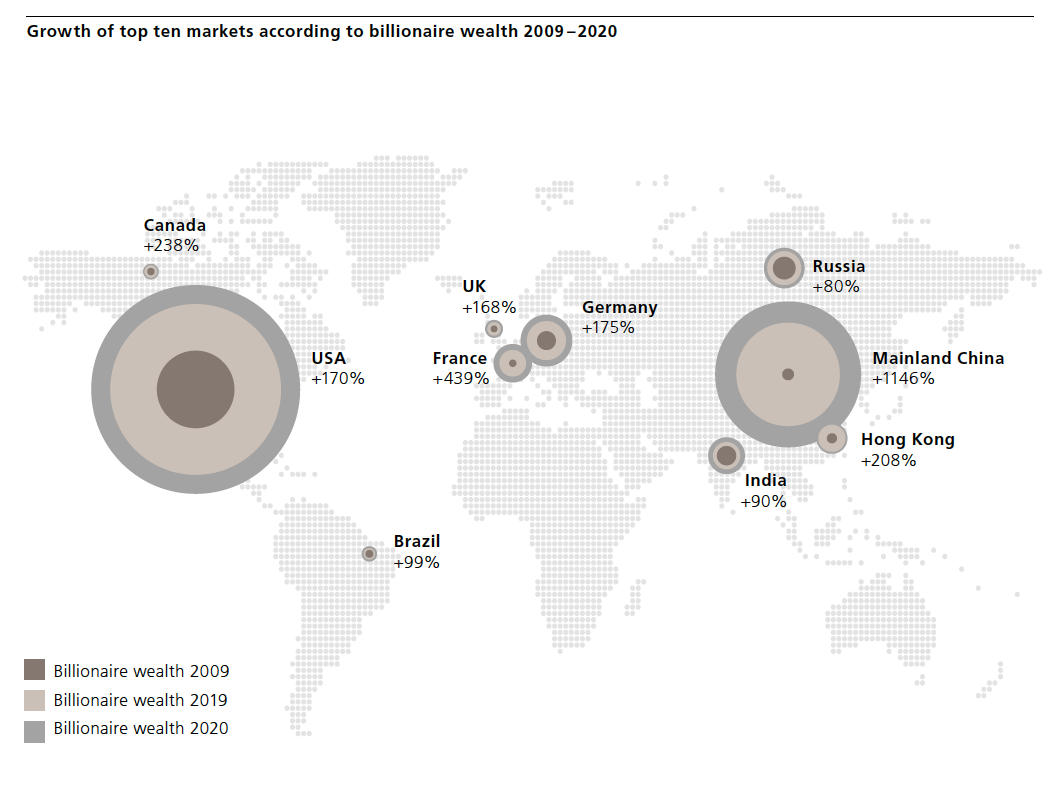

“This polarisation between innovator billionaires and the rest comes at the end of a historic decade, when billionaires doubled in number and total wealth almost tripled to $8 trillion," the report said. In these diverging fortunes, tech and healthcare billionaires are the clear winners.

By region, unsurprsingly, billionaire wealth grew fastest in Asia. By early April 2020, there were 389 Chinese billionaires, worth a total of $1.2 trillion. Their wealth had grown by almost 9x, compared with 2x for billionaires in the US.

The fate of real estate was this year's more nuanced story. As a store of value and something tangible to pass on to successors, billionaires are still in love with the asset class. The PwC survey found roughly half of billionaires have 21 to 40 per cent of their net wealth invested in real estate, by far the largest allocation regardless of what sector their wealth has been generated in.

But the global pandemic has put the brakes on commercial property demand, and digital supremacy is challenging the value of physical space.

“Real estate has taken a beating,” head of UBS Global Family Office Josef Stadler said. But how this plays out depends on the still "uncertain future" of home office working.

Today's billionaire innovators are seen as the best hope for boosting productivity and digging the global economy out of its current dilemmas. There's no doubt, the report highlights, that "higher productivity is needed to address the huge public financial deficits, while taking care to reduce social inequality and to tackle the environmental resource scarcity by doing more with less."

It concludes that these billionaires will be seeking to do this not just through the economic contributions of their businesses, but through strategic philanthropy, good corporate citizenship and impact investing. “The pandemic has opened their eyes,” it said.